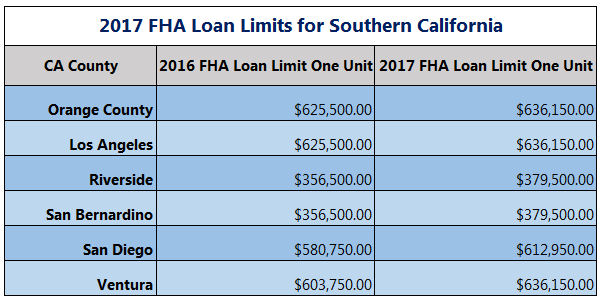

In December of 2016, FHA released an official statement announcing the increase of the 2017 FHA loan limits.

This is the FHA loan limit increase in Orange County, CA since 2006.

What is an “FHA loan limit”?

The Federal Housing Administration (FHA) sets a limit, effective each new year, of what a buyer can borrow within each state county. They calculate this limit based on the average price a home is selling for in that area. That means that in places like Orange County the limit will be significantly higher than in a county with lower housing prices like Riverside County. This does not mean that you cannot purchase a home at a higher sales price, just that you as the buyer, will be responsible for coming in with the difference between the loan limit and the purchase price.

What does this mean for Orange County Buyers?

This is an encouraging change for many prospective Orange County home buyers that have the income, satisfactory credit, appropriate debt-to-income ratios but may not have the savings for a conventional loan program. The FHA loan limit for Orange County is now at $636,150. That is up $10,650 from last years limit of $625,500. As housing prices increase in this popular area it is a welcome opportunity.

Let’s take a look at the median house prices in a couple of in demand cities to see how this new limit will be impactful:

(Taken from Zillow 1/12/17)

Costa Mesa: $725,200 Huntington Beach: $754,500

Santa Ana: $682,600 Anaheim: $553,900

Cypress: $624,400 Irvine: $776,600

Laguna Niguel: $790,500 Placentia: $661,300

Garden Grove: $545,200 Tustin: $670,400

Now look at the highest purchase price for the new loan limit, with the traditional 3.5% down:

Purchase Price: $659,222 (<–Anything higher than this, the buyer will need a down payment that is more than the minimum 3.5% FHA requirement)

Down Payment 3.5%: $23,073

Base Loan Amt: $636,150

UPMIP: $11,133

Total FHA LA: $647,282

When you take the FHA loan limit increase into consideration, it makes buying in Orange County more attainable. Taken in combination with the FHA announcement that the mortgage insurance premiums have been lowered by .25%, and FHA is becoming even more affordable.

Bottom Line:

FHA is staying true to their core mission as they steadily adjust with the economy. They will effectively help many families to realize their dream of owning a home with an Orange County zip code this year through this loan limit increase.

Authored by Tim Storm, an Orange County, CA Loan Officer. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.OCHomeBuyerLoans.com. I will prepare custom loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.